UK Bandsaw Machines Market Outlook 2026–2036: Precision Cutting Demand Sustains Steady Growth

UK bandsaw machines demand rises steadily as manufacturers prioritise accuracy, uptime, and cost-efficient cutting solutions.

NEWARK, DE, UNITED STATES, January 22, 2026 /EINPresswire.com/ -- Market Overview and Growth Outlook

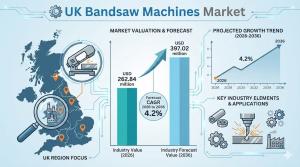

The Bandsaw Machines Outlook in the UK highlights a market driven by precision manufacturing needs and disciplined production planning. Demand for bandsaw machines in the UK is valued at USD 262.84 million in 2026 and is projected to reach USD 397.02 million by 2036, expanding at a CAGR of 4.2%. Growth reflects consistent investment across metalworking shops, automotive component suppliers, contract manufacturers, furniture makers, and general manufacturing units.

This demand curve is shaped by day-to-day cutting and fabrication decisions where cut accuracy, kerf control, and repeatability directly influence throughput. Buyers increasingly assess value through reduced cycle time, stable blade life, and lower rework rates rather than upfront equipment cost alone.

Key growth indicators include:

- Rising emphasis on predictable cut geometry to support downstream welding and machining

- Increased focus on uptime and reduced operator fatigue

- Preference for machines that maintain tolerance during long production runs

Manufacturing Momentum Supporting Equipment Investment

UK manufacturing activity continues to provide a stable foundation for equipment procurement. Official production data indicated a 0.5% month-on-month increase in manufacturing output in October 2025, reflecting broad-based operational momentum. In this environment, factory managers prioritise equipment that prevents bottlenecks and safeguards delivery schedules.

Subscribe for Year-Round Insights → Stay ahead with quarterly and annual data updates:

https://www.futuremarketinsights.com/reports/sample/rep-gb-31633

Procurement conversations increasingly extend beyond the saw itself to include blade selection, coolant management, guarding systems, and service responsiveness. Standardising machine settings across sites, accelerating operator training, and ensuring predictable maintenance cycles are key adoption drivers for both large plants and small job shops.

End-Use Trends Defining Demand Patterns

Metalworking remains the largest end-use segment, accounting for 37.0% of total UK demand. Fabrication facilities depend on bandsaw machines for consistent sectioning of bars, tubes, and profiles where cut stability improves fit-up time and downstream efficiency.

Why metalworking leads demand:

- High reliance on straight, repeatable cuts

- Reduced variation across operators through controlled feed and blade tension

- Direct impact on welding, machining, and assembly quality

Woodworking and mixed-material workshops also contribute to steady demand, particularly where finish quality, operator safety, and kerf discipline are critical.

Motor Power and Orientation Preferences

Medium duty motor power dominates with a 45.0% share, reflecting the needs of workshops handling varied job lots. These systems balance flexibility and durability without the cost burden of heavy-duty configurations.

Key reasons for medium duty dominance:

- Adequate power for routine production tasks

- Stable torque response under mixed material loads

- Manageable maintenance and service intervals

Horizontal bandsaw machines lead orientation preferences with a 55.0% share. Their operational simplicity, safer clamping, and suitability for batch processing make them a preferred choice in production-led environments.

Cutting Range and Operation Insights

Bandsaw machines with a cutting range up to 200 mm account for 35% of demand, indicating that most UK applications focus on standard component sizes rather than extreme heavy-section cutting.

Key buying priorities in this range:

- Accuracy and minimal burr formation

- Faster cycle control for repeat jobs

- Compatibility with common blade materials

Manual operation continues to dominate with a 56.0% share. Many UK workshops favour operator-led systems for flexibility, quick setup changes, and lower automation complexity, especially where job variety remains high.

Safety, Compliance, and Buying Behaviour

Safety and regulatory compliance strongly influence procurement decisions. UK guidance on narrow band saws emphasises guarding, blade containment, and operator protection, pushing buyers toward equipment with robust safety features and clear documentation.

Compliance-driven considerations include:

- Guarding systems that reduce blade contact risk

- Supplier support for conformity and installation readiness

- Ease of maintaining safety components over machine life

Regional Performance Across the UK

Regional demand varies based on manufacturing density and service coverage. England leads growth at 4.6%, supported by higher concentration of fabrication facilities and faster replacement cycles. Scotland follows at 4.1%, driven by reliability-focused buying. Wales grows at 3.8% through cost-disciplined, multi-use equipment selection, while Northern Ireland advances at 3.4% with value-driven adoption of proven configurations.

Competitive Landscape and Strategic Focus

Competition in the UK bandsaw machines market centres on cut reliability, lifecycle cost control, and service responsiveness. Buyers evaluate suppliers on machine rigidity, blade handling stability, ease of alignment, and speed of uptime restoration.

Key companies shaping the market include:

- Starrett (The L.S. Starrett Companies)

- KASTO Maschinenbau GmbH & Co. KG

- Cosen Saws

- HE&M Saw

- ITL Industries Ltd.

Market Outlook

As UK manufacturers continue to prioritise efficiency, safety, and precision, bandsaw machines are positioned as strategic production assets rather than basic cutting tools. Steady growth through 2036 reflects their critical role in maintaining competitive manufacturing operations.

Related Reports

Military Parachute Market – https://www.futuremarketinsights.com/reports/military-parachute-market

Automated Parcel Delivery Terminals Market – https://www.futuremarketinsights.com/reports/automated-parcel-delivery-terminals-market

Automatic Checkweigher Market – https://www.futuremarketinsights.com/reports/automatic-checkweigher-market

Have a specific Requirements and Need Assistant on Report Pricing or Limited Budget please contact us - sales@futuremarketinsights.com

About Future Market Insights (FMI)

Future Market Insights, Inc. (FMI) is an ESOMAR-certified, ISO 9001:2015 market research and consulting organization, trusted by Fortune 500 clients and global enterprises. With operations in the U.S., UK, India, and Dubai, FMI provides data-backed insights and strategic intelligence across 30+ industries and 1200 markets worldwide.

Contact Us:

Future Market Insights Inc.

Christiana Corporate, 200 Continental Drive,

Suite 401, Newark, Delaware - 19713, USA

T: +1-347-918-3531

Why FMI: https://www.futuremarketinsights.com/why-fmi

For Sales Enquiries: sales@futuremarketinsights.com

Website: https://www.futuremarketinsights.com

LinkedIn| Twitter| Blogs | YouTube

Sudip Saha

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.