Financial Services Market In 2029

The Business Research Company’s Financial Services Global Market Report 2025 – Market Size, Trends, And Forecast 2025-2034

LONDON, GREATER LONDON, UNITED KINGDOM, December 23, 2025 /EINPresswire.com/ -- Financial Services Market to Surpass $47,673 billion in 2029.

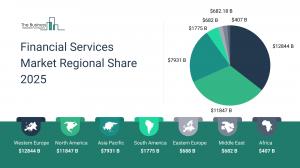

Which Will Be the Biggest Region in the Financial Services Market in 2029

Western Europe will be the largest region in the financial services market in 2029, valued at $17,051 billion. The market is expected to grow from $12,001 billion in 2024 at a compound annual growth rate (CAGR) of 7%. The strong growth can be attributed to the rising digitalization and increasing government support.

Which Will Be The Largest Country In The Global Financial Services Market In 2029?

The USA will be the largest country in the financial services market in 2029, valued at $14,145 billion. The market is expected to grow from $10,398 billion in 2024 at a compound annual growth rate (CAGR) of 6%. The strong growth can be attributed to an increase in the adoption of EMV technology and significant investments.

Request a free sample of the Financial Services Market report

https://www.thebusinessresearchcompany.com/sample_request?id=1859&type=smp

What will be Largest Segment in the Financial Services Market in 2029?

The financial services market is segmented by type into lending and payments, insurance, reinsurance, insurance brokers and agents, investments and foreign exchange services. The lending and payments market will be the largest segment of the financial services market segmented by type, accounting for 37% or $17,678 billion of the total in 2029. The lending and payments market will be supported by the increased adoption of digital payment methods and the expansion of online lending platforms.

The financial services market is segmented by size of business into small and medium business and large business. The large business market will be the largest segment of the financial services market segmented by size of business, accounting for 57% or $27,377 billion of the total in 2029. The large business market will be supported by globalization, technological advancements, focus on sustainable finance, economic recovery and investment opportunities.

The financial services market is segmented by end user into individuals, corporates, government, investment institution. The individual’s market will be the largest segment of the financial services market segmented by end user, accounting for 42% or $19,927 billion of the total in 2029. The individual’s market will be supported by increased consumer awareness, digital transformation and the rising demand for personalized financial solutions.

What is the expected CAGR for the Financial Services Market leading up to 2029?

The expected CAGR for the financial services market leading up to 2029 is 7%.

What Will Be The Growth Driving Factors In The Global Financial Services Market In The Forecast Period?The rapid growth of the global financial services market leading up to 2029 will be driven by the following key factors that are expected to reshape industry structure, risk models, customer experiences and operating models worldwide.

Increase In Crypto Currencies - The increase in crypto currencies will become a key driver of growth in the financial services market by 2029. Increase in crypto currencies is expected to drive the growth of the financial services market due to increasing adoption for digital payments, decentralized finance (DeFi), inflation hedging, institutional investment and growing trust in blockchain technology. Financial services are required for cryptocurrencies to facilitate secure trading, custody, lending and payment processing, ensuring liquidity and stability in the market. As a result, the increase in crypto currencies is anticipated to contributing to a 1.5% annual growth in the market.

Rising Use Of Digital Banking Services - The rising use of digital banking services will emerge as a major factor driving the expansion of the financial services market by 2029. The financial services market by increasing internet penetration, smartphone adoption, demand for convenient financial solutions and advancements in fintech and cybersecurity. Financial services are essential for digital banking to ensure secure transactions, regulatory compliance, fraud prevention and seamless integration with traditional banking systems. Consequently, the rising use of digital banking services capabilities is projected to contributing to a 1.0% annual growth in the market.

Rising Demand For Alternative Investments - The rising demand for alternative investments will serve as a key growth catalyst for the financial services market by 2029. The rising demand for alternative investments is expected to propel financial services market growth due to their potential for higher returns, portfolio diversification, inflation hedging and reduced correlation with traditional assets like stocks and bonds. Financial services are essential for alternative investments to provide expert management, risk assessment, regulatory compliance and access to specialized markets. Therefore, this rising demand for alternative investments operations is projected to supporting to a 0.8% annual growth in the market.

Increasing Government Support - The increasing government support will become a significant driver contributing to the growth of the financial services market by 2029. The increasing government support is expected to drive the market for financial services due to increasing economic uncertainties, global crises, inflationary pressures and the need to stimulate growth, protect industries and support vulnerable populations. Government support positively influences financial services by providing stability through regulations, monetary policies and stimulus measures that enhance liquidity, credit availability and investor confidence. Consequently, the increasing government support strategies is projected to contributing to a 0.5% annual growth in the market.

Access the detailed Financial Services Market report here:

https://www.thebusinessresearchcompany.com/report/financial-services-global-market-report

What Are The Key Growth Opportunities In The Financial Services Market in 2029?

The most significant growth opportunities are anticipated in the financial services for large business market, the individual financial services market, and the financial services for lending and payments market. Collectively, these segments are projected to contribute over $19,302 billion in market value by 2029, driven by accelerating digital financial adoption, advancements in AI-powered automation, modernization of global payment and lending infrastructures, and the rising demand for real-time analytics and personalized financial solutions. This momentum reflects the rapid expansion of seamless digital payment ecosystems, enhanced risk assessment capabilities, and inclusive financial access, all of which are expected to fuel transformative growth across the broader global financial services industry.

The financial services for large business market is projected to grow by $7,602 billion, the individual financial services market by $6,396 billion, and the financial services for lending and payments market by $5,304 billion over the next five years from 2024 to 2029.

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. We have published over 17,500 reports across 27 industries and 60+ geographies. Our research is powered by 1,500,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders.

We provide continuous and custom research services, offering a range of specialized packages tailored to your needs, including Market Entry Research Package, Competitor Tracking Package, Supplier & Distributor Package and much more

Disclaimer: Please note that the findings, conclusions and recommendations that TBRC Business Research Pvt Ltd delivers are based on information gathered in good faith from both primary and secondary sources, whose accuracy we are not always in a position to guarantee. As such TBRC Business Research Pvt Ltd can accept no liability whatever for actions taken based on any information that may subsequently prove to be incorrect. Analysis and findings included in TBRC reports and presentations are our estimates, opinions and are not intended as statements of fact or investment guidance.

The Business Research Company

Americas +1 310-496-7795

Europe +44 7882 955267

Asia & Others +44 7882 955267 & +91 8897263534

Email: info@tbrc.info

Oliver Guirdham

The Business Research Company

+44 7882 955267

info@tbrc.info

Visit us on social media:

LinkedIn

Facebook

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.